Credit unions have websites because they want people to deposit and borrow money. But why do people want things like savings accounts and loans in the first place?

Everyone is seeking for something; and for most people, that “something” is happiness. We all strive for things we believe will make us happy. For instance, I believe that being kind to my wife, having kids, and finding success in my work will produce happiness. As a result of my beliefs, I constantly do things to transport myself from my current situation in life to my desired situation.

Now, I admit I’m a little weird, but not remarkably. So my guess is you want to be happy, too. Furthermore, I bet you pursue happiness every day, consciously or not.

Where wants come from

I’ve met people from all over the world and one of the things that fascinates me most is that all people are more alike than different. Everyone wants to be loved. Everyone needs sleep. Everyone bleeds. Everyone needs air to breathe. And everyone likes bacon. Well, the last one is questionable, but without question everyone has current situations and desired situations. For instance, right now I’m freezing in Utah and I’d rather be warm in Hawaii.

A want (or need) is simply the difference between a desired state and current state. Mathematically you could write it like this:

Desired State – Current State = Want

Hence, the greater your desire, or the more lowly your current circumstance, the greater your want. In other words, the colder it gets in Utah, the more I wish I were on a Hawaiian beach and the more likely I am to plan a “business” trip.

How do you decide what you want? And once you know what you want, how do you get there? Goals and plans are based on beliefs and knowledge, which is why educating is better than promoting.

Educating is better than promoting

Too often, marketers focus only on promotion and forget education. Promotions are effective when you’re speaking to people who are already interested in a product, but fail to persuade people who are currently uninterested. The Ultimate Sales Machine explains that no more than 3% of your total audience wants to buy whatever you’re selling right now. Thus, any given promotion is uninteresting to 97%+ of your audience.

On the other hand, educating is about giving people knowledge and showing them how to act on newfound wisdom. Through education, you show people a desirable state, which creates a need when compared with their current situation. After creating a need, you show them how to get from Point A to Point B. For example, if you can help me understand why I should start saving for retirement now, then opening an IRA will make sense to me.

“The hardest thing we need to do today is grab the attention of potential buyers and keep their attention long enough to help them buy your product. This approach of offering some education of value to them gives you a significant opportunity to attract more buyers and build more credibility. I call this ‘education-based marketing’…you will attract way more buyers if you are offering to teach them something of value to them than you will ever attract by simply trying to sell them your product or service.”

– Chet Holmes, The Ultimate Sales Machine

CEB Challenger, a sales and marketing firm, found customers were far more likely to take action when they encountered information that taught them something new.

From a study by CEB Challenger

Education builds trust and loyalty

Providing educational content builds trust over time, which is essential in the financial sector. MIT’s Business Review surveyed over 1,200 retail clients of Goldman Sachs JBWere Pty Ltd., a financial services company. They used the data to examine the impact of customer education initiatives, and found that “efforts to enhance customers’ knowledge had a positive and strong impact on customer trust.”

Another study done by Pusan National University found customer education was also connected with customer loyalty. The study concluded that customers were more devoted to brands and companies who made a conscious effort to give them plenty of information.

Education gives back

Often on this blog, we love to talk about the bottom line: “Do this, and you’ll get more members. Do this, and you’ll make more money.” But making money isn’t the only goal because credit unions are not-for-profit organizations. Credit unions often find financial education to be fundamentally important, above and beyond any bottom line. As a credit union marketer, you are genuinely interested in helping people understand important financial concepts, so they feel empowered to make smarter financial decisions.

Ways to share educational content

Here are four ways you can start educating.

#1 Start a blog

An effective way you can educate website visitors is through a blog. If you’re not sure where to start, think about some of the most common needs of your members. How do you advise them when they want to buy a home or get a credit card? Then write a post that outlines your answer. Not only does a blog add an educational element to your site, it also gives you a piece of collateral you can use over and over again in other places. An informative blog post can be a great way to spice up your email newsletters, for example.

#2 Build an education center

What is an education center? It’s a place where you collect lessons on financial concepts. For example, you might have a short written lesson on how to budget, a powerpoint on getting a car loan, or a video on how an IRA works.

Tip: If you have the resources, we suggest creating video lessons because research shows that videos tend to get more engagement than other options.

#3 Showcase frequently asked questions

The right list of FAQs can transform a regular product page into a wealth of clearly organized information. No longer do users need to hunt for what they need most. Instead, it’s right there in front of him. Putting answers in front of people is important. A study by Forrester reported that 53% of US adults are likely to abandon online purchases if they can’t find quick answers to their questions. Furthermore, having FAQs on your site can reduce the burden on your call center.

Example of an FAQs page on OEFCU.org, a website recently designed by BloomCU.

#4 Get Creative

The ideas above are three proven practices, but you don’t have to limit yourself to what’s been tried before. Get creative with how you choose to educate members and potential members. On a recent design we did for United Texas, we added a tips section to each of their product pages. Each set of tips is relevant to the product at hand. For example, on the Platinum MasterCard page, we included a section entitled “3 things you should know about EMV chip cards.”

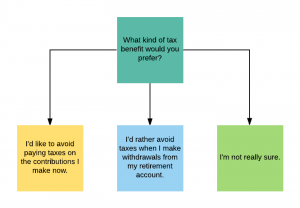

For YoloFCU.org, we created interactive quizzes to help users find the best products for them; e.g., “Which IRA is right for you?” The quiz takes the user through some questions, then recommends a Traditional or Roth IRA. These quizzes help users understand different account types and other financial concepts in a fun way, and aid them in making sure they’ve landed on the right product page.

The beginning of an educational quiz flow

So, promote less and educate more. Doing so will build trust, improve your marketing, and help you give back to your community.

Want more insights?

Get our crazy ideas and doable tips in your inbox.